Total revenues in the three O-S-D market segments climbed 11% in 2017—the strongest growth rate since 2010—and continue to be driven by high demand for sensors, actuators, CMOS imaging devices, light sensors, laser transmitters, and power discretes.

Combined sales for optoelectronics, sensors/actuators, and discrete semiconductors (known collectively as O-S-D) increased 11% in 2017—more than 1.5 times the average annual growth rate in the past 20 years—to reach an eighth consecutive record-high level of $75.3 billion, according to IC Insights’ new 2018 O-S-D Report—A Market Analysis and Forecast for Optoelectronics, Sensors/Actuators, and Discretes. Total O-S-D sales growth is expected to ease back in 2018 but still rise by an above average rate of 8% in 2018 to $81.1 billion, based on the five-year forecast of the new 375-page annual report, which became available this week.

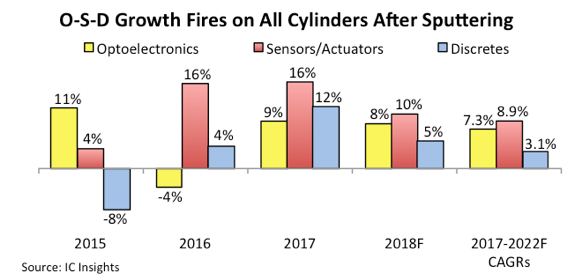

In 2017, optoelectronics sales recovered from a rare decline of 4% in 2016, rising 9% to $36.9 billion, while the sensors/actuators market segment registered its second year in a row of 16% growth with revenues climbing to $13.8 billion, and discretes strengthened significantly, increasing 12% to $24.6 billion. The new O-S-D Report forecast shows optoelectronics sales growing 8% in 2018, sensors/actuators rising 10%, and discretes growing 5% this year (Figure 1).

Figure 1

Between 2017 and 2022, sales in optoelectronics are projected to increase by a compound annual growth rate (CAGR) of 7.3% to $52.4 billion, while sensors/actuators revenues are expected to expand by a CAGR of 8.9% to $21.2 billion, and the discretes segment is seen as rising by an annual rate of 3.1% to $28.7 billion in the final year of the report’s forecast. In the five-year forecast period, O-S-D growth will continue to be driven by strong demand for laser transmitters in optical networks and CMOS image sensors in embedded cameras, image recognition, machine vision, and automotive applications as well as the proliferation of other sensors and actuators in intelligent control systems and connections to the Internet of Things (IoT). Power discretes (transistors and other devices) are expected to get a steady lift from the growth in mobile and battery-operated systems as well as good-to-modest global economic growth in most of the forecast years through 2022, the report says.

Combined sales of O-S-D products accounted for about 17% of the world’s $444.7 billion in total semiconductor sales compared to less than 15% in 2007 and under 13% in 1997. Since the mid-1990s, total O-S-D sales growth has outpaced the much larger IC market segment because of strong and relatively steady increases in optoelectronics and sensors. However, this trend was reversed recently mostly due to a 77% surge in sales of DRAMs and 54% jump in NAND flash memory in 2017.

The 2017 increase for total O-S-D sales was the highest growth rate in the market group since the 37% surge in the strong 2010 recovery year from the 2009 semiconductor downturn. In addition, 2017 was the first year since 2011 when all three O-S-D market segments reached individual record-high sales, says IC Insights’ new report. The 2018 O-S-D Report also shows that sales of sensor and actuator products made with microelectromechanical systems (MEMS) technology grew 18% in 2017 to a record-high $11.5 billion.

Report Details: The 2018 O-S-D Report