Over the last decade, unmanned aerial vehicles and systems (UAV and UAS)—also referred to as drones—have become widely popular and gained significant interest in commercial, consumer and government markets. What used to be a largely military application now has more than 400 companies, worldwide, developing drone technology and enabling use cases for the new era of commercial drones. The premise of a flying object performing mission and business critical tasks, without much human involvement, offers a pivotal moment in the realm of smart automation and productivity. Unfortunately, regulations by the U.S. Federal Aviation Administration (FAA) and other agencies, despite their positive intentions, limit the mass application of these drones. Additionally, growing competition is leading to commoditization before the market has even gained its footing. This article discusses how innovations in RF and microwave technology can provide a technical justification to ease the regulatory barriers and help drone manufacturers differentiate their solutions to better succeed in the marketplace.

The concept of UAV/UAS is not new and has been advocated in some shape or form since manned aircraft became widely used. Unfortunately, the limits of material science, propulsion, power and battery, sensor and software technologies have limited the use of drones to very specific industries and applications. Only large military forces could justify the cost to develop and use drones for intelligence, reconnaissance and surveillance missions in environments too dangerous for humans. Even today, many of us relate drones to military missions that are commonly in the news.

Alternatively, low-cost, bare bones drones have been gaining popularity among enthusiasts and hobbyists for recreational purposes. Although drones have not been widely used for commercial applications, that is changing as the industry improves component technology and computing software. With the advent of industrial robots, autonomous driving, new propulsion technology and power efficient systems, the transition to UAVs is a natural evolution. An unmanned flying object that can be programmed to perform tasks that are too dangerous, time consuming or difficult for humans is a huge technological leap toward a more automated and productive world.

CHALLENGING OPPORTUNITY

The drone market is expected to grow to about $21 billion by 2022.1 Today, about 82 percent of the market is focused on military applications. Commercial drones are expected to account for about $2.5 billion in revenue by 2021, representing a 19 percent year-over-year growth rate. The use cases in commercial and industrial markets range widely. Drones are being explored for applications such as precision agriculture (e.g., crop spraying), terrain and environmental monitoring, infrastructure monitoring (e.g., bridges and dams), public safety surveillance, commercial freight, border control and oil and gas pipeline monitoring. Each month, dozens of new companies introduce products and services using drone technology to solve business problems. The prospects for commercial UAV applications are virtually limitless.

Unfortunately, even though the drone market is becoming widely popular, with multiple companies exploring many use cases (e.g., Amazon and Alphabet’s Google), the industry faces challenges limiting its growth.

Heavily regulated and restricted—The FAA has strict rules that limit the use of drones in public air space. A 2015 ruling stipulates that drones weighing less than 55 pounds may only operate during the day and within the visual line-of-sight of the operator. These drones are not allowed to operate autonomously, reflecting the FAA’s safety and security concerns. From the government’s standpoint, the risk posed by most drones, not equipped with reliable and accurate sensors, is too high to allow operation in open public spaces. While exceptions are granted (e.g., in large open agricultural areas), in the majority of cases, due to limited sensor technology and unproven sensor reliability, the FAA has taken a more conservative stance to ensure safety and security.

Competitive threats and commoditization—In addition to regulatory hurdles, the drone market is increasingly competitive, which creates pricing pressure. Drawn by UAVs’ attractive growth potential and “cool” factor, more than 400 companies worldwide are already involved in drone-related development. The focus for most of these companies is differentiated hardware, rather than emphasizing the value-added services their drones may enable.

Limited RF and microwave expertise—To achieve widespread use, commercial and consumer drones must be equipped with navigational sensors that ensure safe and reliable autonomous operation. As in the automotive and industrial equipment markets, many of these wireless sensors use RF and microwave technology. Yet most commercial companies developing drones are startups with limited expertise in RF and microwave design. Even well-established industrial equipment manufacturers with some RF experience are hard-pressed to quickly evaluate, design and manufacture radar sensor solutions for the fast changing UAV market.

The lack of RF expertise and readily available radar solutions creates a challenging cycle for the industry: the UAV market’s inability to offer reliable sensors to help ensure safe and reliable autonomous operation prevents government agencies from relaxing the regulations that restrict autonomous drone operation.

RADAR TO THE RESCUE

At Analog Devices, we believe UAV manufacturers have an opportunity to influence regulatory policies governing drone operation by embracing the RF, microwave and mmWave technology that can enable the sensors needed to prove the safe, reliable navigation of drones. A 24 GHz radar, operating in the globally recognized industrial, scientific and medical (ISM) band, is one example of a basic and versatile sensor for multiple use cases. An ISM band radar at 24 GHz can be used without regulation anywhere in the world for functions such as automatic collision avoidance and radio altimeters. In addition to measuring how high the drone is flying, the same radar can detect and track multiple objects—two of the most basic requirements for safe drone operation.

By proving their solutions are technically capable of operating autonomously, UAV manufacturers will be able to influence the existing regulations, rather than waiting for regulators to define the way the industry should operate. To reach this point, UAV manufacturers need to take three steps:

- Develop a basic understanding of radar and its various modes

- Understand the components of the RF signal chain required for a complete radar solution

- Adopt radar solutions that provide a complete hardware setup with the software algorithms to allow them to get to market faster.

The following discussion provides an overview of these steps and a potential solution to help UAV manufacturers adopt 24 GHz radar for collision avoidance and radio altimeter applications.

Basics of Radar

Radar sensors are commonly used in the automotive and industrial markets to detect, measure and track objects, e.g., blind spot detection and automotive driver assistance systems (ADAS). Compared to optical or ultrasonic sensors, radar can accurately detect and measure objects over a much longer range and wider field of view in very difficult environments, including dust, smoke, snow, fog and poor lighting. A typical radar has various modes, each best depending on what needs to be detected and tracked.

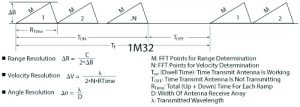

FMCW—Operating in the frequency modulated continuous wave (FMCW) mode, the radar measures the distance to stationary targets. By modulating the frequency, also referred to as an FMCW ramp or chirp, the radar measures the response of the reflected wave to derive range, velocity and the angle of the target. Figure 1 shows how the target’s range, velocity and angle are derived in FMCW mode.

Figure 1 FMCW radar operation.

The range resolution depends on the transmitter’s carrier sweep bandwidth; the higher the bandwidth, the higher the resolution of the radar sensor. The velocity resolution depends on dwell time and carrier frequency; the higher the carrier frequency or dwell time, the higher the resolution. Angular resolution depends on the carrier frequency; the higher the carrier frequency, the better the resolution.

Compared to laser detection, which measures a single spot, or camera detection, which only captures a 2D image within the camera’s field of view, FMCW radars provide a continuous, inherent average of the information from the target’s reflection. This provides a wide, 3D field of view by measuring the distance, speed and angle, from as close as a few centimeters to several hundred meters between the sensor and the targets.

Range-Doppler—In range-Doppler mode, the range and speed of the target are analyzed. Range-Doppler is one of the most powerful modes because it processes multiple transmit ramps or chirps simultaneously using a 2D Fourier transform. The processed range-Doppler data is displayed in a 2D map that enables targets with different velocities to be separated, even if they are the same distance from the sensor. This is important to distinguish multiple targets moving at high speed in different directions, e.g., resolving complicated air traffic scenarios with targets traveling in opposite directions or during overtaking maneuvers.

DBF—With digital beamforming (DBF), the distance and the angle to the target are displayed. The receive signals from the four receive channels are used to estimate the angle of the target, and the data contains the spatial distribution of the targets in the xy-plane. In the DBF mode, the system is configured the same as FMCW; however, the down-converted IF signals are processed differently. After calculating range, the angle information of the target is calculated by evaluating the phase differences between the four receive channels. The DBF mode requires a calibration of the radar front-end to eliminate deterministic phase variations between the receive channels.

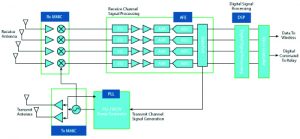

Figure 2 Multi-channel radar sensor developed by Analog Devices.

24 GHz Multi-Channel Radar

A 24 GHz radar is widely used in commercial and industrial applications, offering high accuracy, low power consumption and small size. These characteristics also make a 24 GHz radar a good fit for commercial and consumer UAV manufacturers, particularly considering the desire to reduce payload and power requirements. One such system developed by Analog Devices is shown in Figure 2.

A common misconception is the radar can operate at 77 GHz rather than 24 GHz. Current regulations dedicate the 77 GHz band to automotive vehicles and do not allow use with UAVs. While 77 GHz offers higher bandwidth for improved resolution, today’s regulations prohibit a 77 GHz radar being used for UAV applications.

When building a radar sensor, every dB improvement in receiver sensitivity extends the detection range. Most sensors available today focus on cost reduction, trading off phase noise and the number of channels. This trade-off degrades the receiver signal-to-noise (SNR) ratio, which limits the detection of smaller targets in the presence of larger objects. In real-world radar applications, busy or cluttered target scenarios cumulatively increase system phase noise and desensitize the radar receiver. The higher system noise masks or hides small targets and prevents object detection—detecting a narrow tree branch masked by the façade of a building—which can compromise UAV safety. Most single-channel, single chip, low-cost sensors do not provide the needed performance to make this distinction.

Using a 24 GHz multi-channel platform with higher performance, UAV manufacturers can:

- Use the FMCW radar mode to detect the range and velocity of objects up to 200 m with a resolution of approximately 60 cm; the resolution can be improved to 15 cm using an antenna design developed for the specific application.

- Achieve a field of view of approximately 120 degrees in azimuth and 15 degrees in elevation, depending on the antenna array design; using DBF, the field of view can be extended.

- Reduce power consumption while improving sensitivity 2x and extending the detection range 1.5x compared to traditional low-cost, single-channel radar sensors.

SUMMARY

The UAV/UAS market is growing quickly and offers tremendous potential for many new commercial applications. The landscape of sensor technologies is also changing rapidly, with newer sensor technologies such as light detection and ranging (LiDAR), time of flight (ToF) and ultrasonic being developed and adopted. UAV manufacturers should be aware of these newer options and incorporate the latest technologies as they mature.

However, radar remains the most compelling sensor technology, offering performance and versatility. To help the widespread commercial adoption of UAVs, UAV manufacturers need to lead the industry by embracing RF, microwave and mmWave radar, considering more than just the cost of the hardware, to demonstrate that UAVs can be safely operated autonomously.

Reference