Embedded imaging applications in cars, security, machine vision, medical, virtual reality, wearable systems, and other new uses will offset slow growth in camera phones, says report.

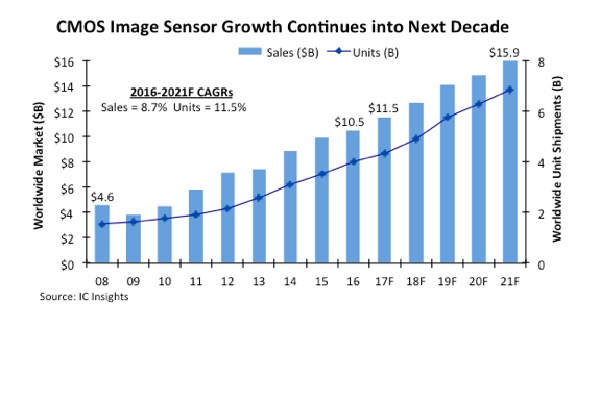

CMOS image sensor sales are on pace to reach a seventh straight record high this year and nothing ahead should stop this semiconductor product category from breaking more annual records through 2021 (Figure 1), according to IC Insights’ 2017 O-S-D Report—A Market Analysis and Forecast for Optoelectronics, Sensors/Actuators, and Discretes.

After rising 9% in 2017 to about $11.5 billion, worldwide CMOS image sensors sales are expected to increase by a compound annual growth rate (CAGR) of 8.7% to $15.9 billion in 2021 from the current record high of $10.5 billion set in 2016, based on the five-year forecast in the 360-page O-S-D Report, which covers more than 40 different product categories across optoelectronics, sensors and actuators, and discrete semiconductors.

After strong growth from the first wave of digital cameras and camera-equipped cellphones, image sensor sales leveled off in the second half of the last decade. However, another round of strong growth has begun in CMOS image sensors for new embedded cameras and digital imaging applications in automotive, medical, machine vision, security, wearable systems, virtual and augmented reality applications, and user-recognition interfaces.

Competition among CMOS image sensor suppliers is heating up for new three-dimensional sensing capability using time-of-flight (ToF) technology and other techniques for 3D imaging and distance measurements. ToF determines and senses the distance of faces, hand gestures, and other things by measuring the time it takes for light to bounce back to sensors from emitted light (often an infrared laser or LED). CMOS technology has progressed to the point of supporting integration of ToF functions into small chip modules and potentially down to a single die. Sony, Samsung, OmniVision, ON Semiconductor, STMicroelectronics, and others have rolled out and developed 3D image sensors. Infineon has also jumped into the image sensor arena with a 3D offering that is built in ToF-optimized CMOS technology.

Automotive systems are forecast to be the fastest growing application for CMOS image sensors, rising by a CAGR of 48% to $2.3 billion in 2021 or 14% of the market’s total sales that year, according to the 2017 O-S-D Report. CMOS image sensor sales for cameras in cellphones are forecast to grow by a CAGR of just 2% to $7.6 billion in 2021, or about 47% of the market total versus 67% in 2016 ($7.0 billion). Smartphone applications are getting a lift from dual-camera systems that enable a new depth-of-field effect (known as “bokeh”), which focuses on close-in subjects while blurring backgrounds—similar to the capabilities of high-quality single-lens reflex cameras.

Report Details: The 2017 O-S-D Report

In a one-of-a-kind study, IC Insights continues to expand its coverage of the semiconductor industry with detailed analysis of trends and growth rates in the optoelectronics, sensors/actuators, and discretes market segments in its newly revised 360-page O-S-D Report—A Market Analysis and Forecast for the Optoelectronics, Sensors/Actuators, and Discretes.

Now in its 12th annual edition, the 2017 O-S-D Report contains a detailed forecast of sales, unit shipments, and selling prices for more than 30 individual product types and categories through 2021. Also included is a review of technology trends for each of the segments. The 2017 O-S-D Report, with more than 240 charts and figures, is attractively priced at $3,590 for an individual-user license and $6,690 for a multi-user corporate license.

To review additional information about IC Insights’ new and existing market research reports and services please visit our website: www.icinsights.com