-Quarterly GAAP gross margin of 54 percent; Quarterly non-GAAP gross margin from continuing operations of 62 percent

-Quarterly GAAP diluted EPS of $1.49; Quarterly non-GAAP diluted EPS from continuing operations of $2.51

SAN JOSE, Calif., and SINGAPORE, Dec. 02, 2015 (GLOBE NEWSWIRE) — Avago Technologies Limited (Nasdaq:AVGO), a leading semiconductor device supplier to the wireless, enterprise storage, wired, and industrial end markets, today reported financial results for the fourth fiscal quarter and fiscal year ended November 1, 2015, and provided guidance for the first quarter of its fiscal year 2016.

Basis of Presentation

Avago’s financial results include results from LSI Corporation’s (“LSI”) continuing operations starting the third fiscal quarter of 2014, from PLX Technology Inc. starting in the fourth fiscal quarter of 2014, and from Emulex Corporation (“Emulex”) starting the third fiscal quarter of 2015, in each case from the date of their acquisition. The financial results from businesses that have been classified as discontinued operations in the Company’s financial statements are not included in the results presented below, unless otherwise stated.

Fourth Quarter Fiscal Year 2015 GAAP Results

Net revenue was $1,840 million, an increase of 6 percent from $1,735 million in the previous quarter and an increase of 16 percent from $1,590 million in the same quarter last year. Gross margin was $997 million, or 54 percent of net revenue. This compares with gross margin of $884 million, or 51 percent of net revenue last quarter, and gross margin of $788 million, or 50 percent of net revenue in the same quarter last year. Operating expenses were $483 million. This compares with $585 million in the prior quarter and $487 million for the same quarter last year. Operating income was $514 million, or 28 percent of net revenue. This compares with operating income of $299 million, or 17 percent of net revenue, in the prior quarter, and $301 million, or 19 percent of net revenue, in the same quarter last year. Net income, which includes the impact of discontinued operations, was $429 million, or $1.49 per diluted share. This compares with net income of $240 million, or $0.84 per diluted share, for the prior quarter, and $135 million, or $0.50 per diluted share in the same quarter last year. The Company’s cash balance at the end of the fourth fiscal quarter was $1,822 million, compared to $1,354 million at the end of the prior quarter. The Company generated $582 million in cash from operations and spent $106 million on capital expenditures in the fourth fiscal quarter of 2015. In addition, during that quarter, the Company realized $47 million in net proceeds from the sale of Emulex’s prior headquarters building. On September 30, 2015, the Company paid a cash dividend of $0.42 per ordinary share, totaling $116 million. Fourth Quarter Fiscal Year 2015 Non-GAAP Results From Continuing Operations The differences between the Company’s GAAP and non-GAAP results are described generally under “Non-GAAP Financial Measures” below, and presented in detail in the financial reconciliation tables attached to this release. Net revenue from continuing operations was $1,853 million, an increase of 6 percent from $1,750 million in the previous quarter, and an increase of 15 percent, from $1,610 million, in the same quarter last year. Gross margin from continuing operations was $1,149 million, or 62 percent of net revenue. This compares with gross margin of $1,063 million, or 61 percent of net revenue, last quarter and gross margin of $939 million, or 58 percent of net revenue, in the same quarter last year. Operating income from continuing operations was $811 million, or 44 percent of net revenue. This compares with operating income from continuing operations of $733 million, or 42 percent of net revenue, in the prior quarter, and $636 million, or 40 percent of net revenue, in the same quarter last year. Net income from continuing operations was $737 million, or $2.51 per diluted share. This compares with net income of $660 million, or $2.24 per diluted share last quarter, and net income of $556 million, or $1.99 per diluted share, in the same quarter last year.

Other Quarterly Data

Fiscal Year 2015 Financial Results From Continuing Operations

GAAP net revenue from continuing operations was $6,824 million, an increase of 60 percent from $4,269 million in the prior year. GAAP gross margin was $3,553 million, or 52 percent of net revenue, versus $1,877 million, or 44 percent of net revenue, in fiscal year 2014. GAAP operating income was $1,632 million compared with $438 million in the prior year. GAAP net income, which includes the impact from discontinued operations, was $1,364 million, or $4.85 per diluted share. This compares with GAAP net income of $263 million, or $0.99 per diluted share, in fiscal year 2014.

Non-GAAP net revenue from continuing operations was $6,905 million, an increase of 60 percent from $4,307 million in the prior year. Non-GAAP gross margin was $4,184 million, or 61 percent of net revenue, versus $2,421 million, or 56 percent of net revenue, in fiscal year 2014. Non-GAAP operating income from continuing operations was $2,926 million. This compares with $1,521 million in the prior year. Non-GAAP net income was $2,613 million, or $8.98 per diluted share. This compares with non-GAAP net income of $1,343 million, or $4.90 per diluted share, in fiscal year 2014.

First Quarter Fiscal Year 2016 Business Outlook

Based on current business trends and conditions, the outlook for continuing operations for the first quarter of fiscal year 2016, endingJanuary 31, 2016, is expected to be as follows:

Projected reconciling items:

Capital expenditures for the first fiscal quarter are expected to be approximately $140 million, which include the purchase of a fabrication facility in Eugene, Oregon for approximately $21 million. For the first fiscal quarter, depreciation is expected to be $61 million and amortization is expected to be $183 million.

The guidance provided above is only an estimate of what the Company believes is realizable as of the date of this release. The guidance also excludes any impact from any mergers, acquisitions and divestiture activity that may occur during the quarter. Actual results will vary from the guidance and the variations may be material. The Company undertakes no intent or obligation to publicly update or revise any of these projections, whether as a result of new information, future events or otherwise, except as required by law.

Avago will be meeting investors at the Barclays Global Technology, Media and Telecommunications Conference on December 9, 2015 in San Francisco. Avago will also be meeting with investors on January 5-7, 2016, at the 2016 International CES and presenting at the J.P. Morgan Tech Forum CES 2016 and the Citi Internet, Media and Telecommunication Tech Forum CES 2016 in Las Vegas.

Financial Results Conference Call

Avago Technologies Limited will host a conference call to review its financial results for the fourth quarter and fiscal year ended November 1, 2015, and to provide guidance for the first quarter of fiscal year 2016, today at 2:00 p.m. Pacific Time. Those wishing to access the call should dial (866) 310-8712; International +1 (720) 634-2946. The passcode is 77298772. A replay of the call will be accessible for one week after the call. To access the replay dial (855) 859-2056; International +1 (404) 537-3406; and reference the passcode: 77298772. A webcast of the conference call will also be available in the “Investors” section of Avago’s website at www.avagotech.com.

Non-GAAP Financial Measures

In addition to GAAP reporting, Avago provides investors with net revenue, net income, operating income, gross margin, operating expenses and other data, on a non-GAAP basis. This non-GAAP information includes the effect of purchase accounting on revenues, and excludes amortization of intangible assets, share-based compensation expense, restructuring and asset impairment charges, acquisition-related costs, including integration costs, purchase accounting effect on inventory, write-off of debt issuance costs, gain on extinguishment of debt, income (loss) from and gain (loss) on discontinued operations and income tax effects of non-GAAP reconciling adjustments. Management does not believe that these items are reflective of the Company’s underlying performance. The presentation of these and other similar items in Avago’s non-GAAP financial results should not be interpreted as implying that these items are non-recurring, infrequent or unusual. Avagobelieves this non-GAAP financial information provides additional insight into the Company’s on-going performance and has therefore chosen to provide this information to investors for a more consistent basis of comparison and to help them evaluate the results of the Company’s on-going operations and enable more meaningful period to period comparisons. These non-GAAP measures are provided in addition to, and not as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. A reconciliation between GAAP and non-GAAP financial data is included in the supplemental financial data attached to this press release.

About Avago Technologies Limited

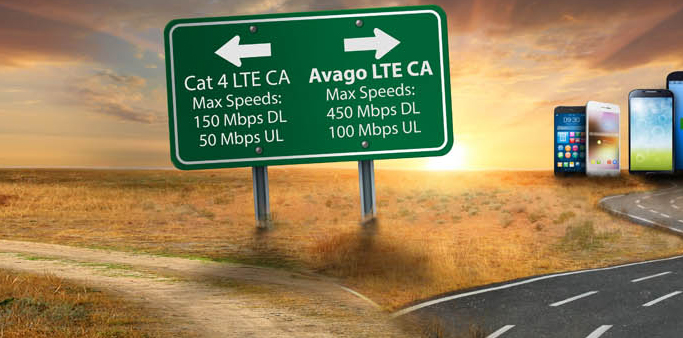

Avago Technologies Limited is a leading designer, developer and global supplier of a broad range of analog, digital, mixed signal and optoelectronics components and subsystems with a focus in III-V compound and CMOS based semiconductor design and processing. Avago’s extensive product portfolio serves four primary target markets: wireless communications, enterprise storage, wired infrastructure, and industrial and other.

Cautionary Note Regarding Forward-Looking Statements

This announcement contains forward-looking statements that address our expected future business and financial performance. These forward-looking statements are based on current expectations, estimates, forecasts and projections of future Company or industry performance, based on management’s judgment, beliefs, current trends and market conditions, and involve risks and uncertainties that may cause actual results to differ materially from those contained in the forward-looking statements. Accordingly, we caution you not to place undue reliance on these statements. Particular uncertainties that could materially affect future results include any loss of our significant customers and fluctuations in the timing and volume of significant customer demand; risks associated with our pending acquisition ofBroadcom Corporation (“Broadcom”), including (1) the risk that the conditions to the closing of the transaction are not satisfied; (2) litigation challenging the transaction; (3) uncertainties as to the timing of the consummation of the transaction and the ability of each party to consummate the transaction; (4) risks that the proposed transaction disrupts our current plans and operations; (5) our ability to retain and hire key personnel; (6) competitive responses to the proposed transaction; (7) unexpected costs, charges or expenses resulting from the transaction; (8) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the transaction; (9) our ability to realize the benefits of the acquisition of Broadcom, as well as delays, challenges and expenses associated with integrating the businesses and the indebtedness planned to be incurred in connection with the transaction; and (10) legislative, regulatory and economic developments; delays, challenges and expenses associated with integrating acquired companies with our existing businesses and our ability to achieve the benefits, growth prospects and synergies expected from acquisitions we may make; our ability to increase our internal manufacturing capacity to meet customer demand; our ability to accurately estimate customers’ demand and adjust supply chain and third party manufacturing capacity accordingly; our ability to improve our manufacturing efficiency and quality; increased dependence on a small number of markets; quarterly and annual fluctuations in operating results; cyclicality in the semiconductor industry or in our target markets; global economic conditions and concerns; our competitive performance and ability to continue achieving design wins with our customers, as well as the timing of those design wins; rates of growth in our target markets; our dependence on contract manufacturing and outsourced supply chain and our ability to improve our cost structure through our manufacturing outsourcing program; prolonged disruptions of our or our contract manufacturers’ manufacturing facilities or other significant operations; our dependence on outsourced service providers for certain key business services and their ability to execute to our requirements; our ability to maintain or improve gross margin; our ability to maintain tax concessions in certain jurisdictions; our ability to protect our intellectual property and the unpredictability of any associated litigation expenses; any expenses or reputational damage associated with resolving customer product and warranty and indemnification claims; dependence on and risks associated with distributors of our products; our ability to sell to new types of customers and to keep pace with technological advances; market acceptance of the end products into which our products are designed; the significant indebtedness incurred by us, including the need to generate sufficient cash flows to service and repay such debt; and other events and trends on a national, regional and global scale, including those of a political, economic, business, competitive and regulatory nature. Our Quarterly Report on Form 10-Q filed on September 10, 2015 and our other filings with the Securities and Exchange Commission, or “SEC” (which you may obtain for free at the SEC’s website at https://www.sec.gov) discuss some of the important risk factors that may affect our business, results of operations and financial condition. We undertake no intent or obligation to publicly update or revise any of these forward looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Additional Information and Where to Find It

This document does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Pavonia Limited (“Holdco”) and Safari Cayman L.P. (“Holdco LP”) filed with theSEC a Registration Statement on Form S-4 which includes the joint proxy statement of Avago and Broadcom and also constitutes a prospectus of Holdco and Holdco LP. On or about September 29, 2015, each of Avago and Broadcom commenced mailing the joint proxy statement/prospectus in definitive form to its shareholders of record as of the close of business on September 25, 2015. Broadcom and Avagoalso plan to file other documents with the SEC regarding the proposed transaction. This document is not a substitute for any prospectus, proxy statement or any other document which Broadcom and Avago has filed or may file with the SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF BROADCOM AND AVAGO ARE URGED TO READ THE DEFINITIVE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

You may obtain copies of all documents filed with the SEC regarding this transaction, free of charge, at the SEC’s website (www.sec.gov). In addition, investors and shareholders will be able to obtain free copies of the joint proxy statement/prospectus and other documents filed with the SEC by the parties on Broadcom’s Investor Relations website (www.broadcom.com/investors) (for documents filed with the SEC byBroadcom) or Avago Investor Relations at (408) 433-8000 or investor.relations@avagotech.com (for documents filed with the SEC byAvago, Holdco or Holdco LP).

AVAGO TECHNOLOGIES LIMITED

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS – UNAUDITED

(IN MILLIONS, EXCEPT PER SHARE DATA)

AVAGO TECHNOLOGIES LIMITED

FINANCIAL RECONCILIATION: GAAP TO NON-GAAP – UNAUDITED

(IN MILLIONS, EXCEPT DAYS)

(1) The number of shares used in the diluted per share calculations on a non-GAAP basis excludes the impact of share-based compensation expense expected to be incurred in future periods and not yet recognized in the financial statements, which would otherwise be assumed to be used to repurchase shares under the GAAP treasury stock method.

(2) Days sales outstanding on a non-GAAP basis includes the impact of the acquisition-related purchase accounting revenue adjustment and excludes the impact of accounts receivable related to discontinued operations.

(3) Inventory days on hand on a non-GAAP basis excludes the impact of purchase accounting on inventory, amortization of intangible assets, share-based compensation expense, restructuring charges, acquisition-related costs, and cost of products sold attributable to discontinued operations.

AVAGO TECHNOLOGIES LIMITED

GAAP AND NON-GAAP NET REVENUE BY SEGMENT – UNAUDITED

(IN MILLIONS, EXCEPT PERCENTAGES)

AVAGO TECHNOLOGIES LIMITED

CONDENSED CONSOLIDATED BALANCE SHEETS – UNAUDITED

(IN MILLIONS)

AVAGO TECHNOLOGIES LIMITED

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS – UNAUDITED

(IN MILLIONS)

Integrated low-power analog peripherals reduce design costs and complexity Devices designed for capturing rapidly changing…

Healthee, the AI-powered platform transforming the health benefits experience, today announced a $50 million Series B funding…

Round led by cybersecurity visionaries SYN Ventures and YL Ventures to accelerate Miggo’s mission to…

The 2025 Cymulate Threat Exposure Validation Impact Report reveals that exposure validation significantly decreases breaches…

DigiKey, a leading global commerce distributor offering the largest selection of technical components and automation…

The round was led by the fund of Dan Caine, Chairman of the Joint Chiefs…