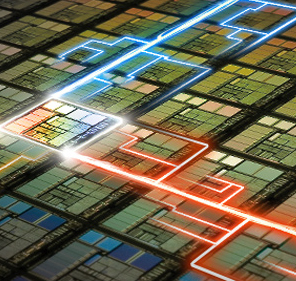

TAIPEI, Taiwan — Taiwan’s semiconductor industry will experience recovery next year on the back of Internet of Things (IoT)-related development, Barclays has predicted. Firms with leading technologies including Taiwan Semiconductor Manufacturing Co. (TSMC, 台積電) and Advanced Semiconductor Engineering Inc. (ASE, 日月光) will be the main beneficiaries, the financial service company said. The rapid development of IoT technology will also give rise to unprecedented big data applications. And semiconductors are an integral part of all of the applications, Barclays said. IoT, big data, advanced computation and car concept innovations will drive the growth momentum in the semiconductor industry, leading firms to new opportunities and new markets, the investment consultancy said. Bellwether companies will benefit the most from the surge in demand. Given the industry’s breakneck technological advances, Barclays predicted that only firms with cutting-edge technical know-how will be able to maintain profitability and market share. Barclays gave TSMC and ASE higher “overweight” ratings, and a “neutral” rating to Siliconware Precision Industries Co. (矽品) and an “underweight” rating to United Microelectronics Corp. (聯電). The semiconductor industry encountered a bottleneck in 2015 due to weak market demand, high inventory levels and the depreciation of the New Taiwan dollar, the investment firm said in its report. The recession will bottom out in the near future as firms make adjustments to production capacity, Barclays said in its forecast.

JPMorgan Projects Revival

JPMorgan Chase concurred and said the industry supply chain has “sprang new bamboo shoots” in its Asian semiconductor report. TSMC’s 28-nanometer facility will see its operation uptime grow to 85-90 percent in the first quarter of 2016, up from 75 percent in the current quarter. The company is stepping up production to answer wireless customers’ needs to refill inventory, JPMorgan said. Inventory level in the industry is declining. The integrated circuit level dropped to 73 days in the third quarter, three days less from the previous quarter. The inventory level is expected to normalize in the fourth quarter, and firms will begin to restock in the first quarter next year, JPMorgan said.

TSMC Could Take All iPhone 7 Orders

In addition, the financial giant said TSMC could be the exclusive A10 processor supplier for the iPhone 7 that will be rolled out next year. TSMC is utilizing its Integrated Fan-Out (InFO) technology, with Apple reportedly being its first major customer. The chip-maker is also improving its 10-nanometer production process, and the test run with static random-access memory has reached a defect-free rate between 40 and 45 percent, which is about the same level as the company’s 20-nano and 16-nano processes. In its report, JPMorgan said orders will pick up over the next couple of months. United Microelectronics will grow in sales in the fourth quarter; however, the scale of increase will fall behind TSMC in the first quarter.

https://www.chinapost.com.tw/taiwan/business/2015/12/01/452281/Semiconductor-sector.htm