Revenue and non-GAAP EPS exceed high end of guidance range, ADI repurchases $112 million of its stock.

- Analog Devices, Inc. (NASDAQ: ADI), a global leader in high-performance semiconductors for signal processing applications, today announced financial results for its fourth quarter of fiscal year 2015, which ended October 31, 2015. “We had another record quarter with revenue and earnings that exceeded the high end of our guidance range,” said Vincent Roche, President and CEO. “Our strategy to leverage technology platforms that sense, measure, and connect real-world phenomena across a diversity of applications once again produced excellent results, as we continue to deliver solid returns on our investments as evidenced in our growth in revenues, profits, and cash flows.” “After a very strong fourth quarter, we are planning for revenue in the seasonally slower first quarter to be in the range of $805 million to $855 million, which would represent the 9th consecutive quarter of year-over-year revenue growth for ADI.”ADI also announced that the Board of Directors has declared a cash dividend of $0.40 per outstanding share of common stock. The dividend will be paid on December 15, 2015 to all shareholders of record at the close of business on December 4, 2015.Results for the Fourth Quarter of Fiscal Year 2015

- Revenue totaled $979 million, up 13% sequentially, and up 20% year-over-year

- GAAP gross margin of 65.6% of revenue; Non-GAAP gross margin of 65.7% of revenue

- GAAP operating margin of 11.1% of revenue; Non-GAAP operating margin of 35.9% of revenue

- GAAP diluted EPS of $0.30; Non-GAAP diluted EPS of $1.03

Results for Fiscal Year 2015

- Revenue totaled $3.4 billion, up 20% year-over-year

- GAAP gross margin of 65.8% of revenue; Non-GAAP gross margin of 66.0% of revenue

- GAAP operating margin of 24.2% of revenue; Non-GAAP operating margin of 33.9% of revenue

- GAAP diluted EPS of $2.20 per share; Non-GAAP diluted EPS of $3.17 per share

- Free Cash Flow of $754 million; or 22% of revenue

- Share repurchases and dividend payments to shareholders totaled $718 million

Please refer to the schedules provided for a summary of revenue and earnings, selected balance sheet information, and the cash flow statement for the fourth quarter and fiscal year 2015, as well as the immediately prior and year-ago quarters. Additional information on revenue by end market is provided on Schedule D. A more complete table covering prior periods is available atinvestor.analog.com.

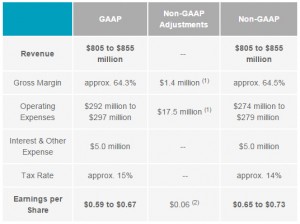

Outlook for the First Quarter of Fiscal Year 2016

The following statements are based on current expectations, and as indicated, are presented on a GAAP and non-GAAP basis. These statements are forward-looking and actual results may differ materially, as a result of, among other things, the important factors discussed at the end of this release. These statements supersede all prior statements regarding our business outlook set forth in prior ADI news releases, and ADI disclaims any obligation to update these forward-looking statements.

- Reflects estimated adjustments for amortization of purchased intangible assets and depreciation of step up value on purchased fixed assets.

- Represents estimated impact of expenses associated with non-GAAP adjustments on a per share basis.

Non-GAAP Financial Information

This release includes non-GAAP financial measures that are not in accordance with, nor an alternative to, generally accepted accounting principles and may be different from non-GAAP measures used by other companies. In addition, these non-GAAP measures are not based on any comprehensive set of accounting rules or principles.

Schedule E of this press release provides the reconciliation of the Company’s historical non-GAAP revenue and earnings measures to its GAAP measures.

Management uses non-GAAP measures to evaluate the Company’s operating performance from continuing operations against past periods and to budget and allocate resources in future periods. These non-GAAP measures also assist management in evaluating the Company’s core business and trends across different reporting periods on a consistent basis. Management also believes that the presentation of these non-GAAP items is useful to investors because it provides investors with the operating results that management uses to manage the Company and enables investors and analysts to evaluate the Company’s core business.

The following item is excluded from our non-GAAP revenue:

Hittite Operations: The results of operation of Hittite from July 22, 2014 through August 2, 2014 have been excluded from our non-GAAP measures because they are not reflective of ongoing operating results.

The following items are excluded from our non-GAAP gross margin, non-GAAP operating expenses, non-GAAP operating income, non-GAAP operating margin, and non-GAAP diluted earnings per share:

Hittite Operations: The results of operation of Hittite from July 22, 2014 through August 2, 2014 have been excluded from our non-GAAP measures because they are not reflective of ongoing operating results.

Acquisition-Related Expenses: Expenses incurred in fiscal 2015 and fiscal 2014 as a result of the Hittite acquisition primarily include: severance payments, expense associated with the fair value adjustments to inventory and property, plant and equipment; and amortization of acquisition related intangibles, which include acquired intangibles such as purchased technology and customer relationships. We excluded these costs from our non-GAAP measures because they relate to a specific transaction and are not reflective of our ongoing financial performance.

Stock-Based Compensation Expense: In the first quarter of fiscal 2015, the Company recorded $3.0 million of stock-based compensation expense for one of its former executive officers due to the accelerated vesting of restricted stock units and a reduction in the requisite service period for stock options in accordance with the terms of the applicable agreements. In addition, in the first quarter of fiscal 2015, the Company recorded $1.3 million of stock-based compensation expense due to the accelerated vesting of restricted stock units and stock options in conjunction with the restructuring charge recorded in the fourth quarter of fiscal 2014. In the fourth quarter of 2014, the Company canceled certain stock awards in conjunction with the restructuring charge which resulted in the recognition of income from stock-based compensation expense recorded in prior periods for these awards. These stock-based compensation expenses and income and the related tax effect have no direct correlation to the operation of our business in the future.

The following items are excluded from our non-GAAP operating expenses, non-GAAP operating income, non-GAAP operating margin, and non-GAAP diluted earnings per share:

Other Operating Expense: Costs incurred as a result of the conversion of the benefits provided to participants in the Company’s Irish defined benefit pension plan to benefits provided under the Company’s Irish defined contribution plan including settlement charges, legal, accounting and other professional fees. We excluded these costs from our non-GAAP measures because they relate to a specific transaction and are not reflective of our ongoing financial performance.

Acquisition-Related Transaction Costs: Costs incurred as a result of the Hittite acquisition in fiscal 2015 and fiscal 2014 including legal, accounting and other professional fees directly related to the Hittite acquisition. We excluded these costs from our non-GAAP measures because they relate to a specific transaction and are not reflective of our ongoing financial performance.

Restructuring-Related Expenses: These expenses are incurred in connection with facility closures, consolidation of manufacturing facilities, severance, and other cost reduction efforts. Apart from ongoing expense savings as a result of such items, these expenses and the related tax effects have no direct correlation to the operation of our business in the future.

The following items are excluded from our non-GAAP other expense and non-GAAP diluted earnings per share:

Acquisition-Related Debt Costs: The Company incurred debt financing costs and interest expense during the third and fourth quarters of fiscal 2014 on its 90-day term loan facility used to finance the Hittite acquisition. We excluded these costs from our non-GAAP measures because they are not reflective of our ongoing financial performance.

The following item is excluded from our non-GAAP diluted earnings per share:

Tax-Related Items: Tax adjustments in fiscal 2015 and fiscal 2014 associated with the Hittite acquisition-related expenses and transaction costs. In addition, in the fourth quarter of 2015, the Company recorded a $13.0 million tax benefit as a result of the reversal of prior period tax liabilities. Also, in the first quarter of 2015, the Company recorded a $7.0 million tax benefit related to the reinstatement of the R&D tax credit in December 2014, retroactive to January 1, 2014. We excluded these tax-related items from our non-GAAP measures because they are not associated with the tax expense on our current operating results.

Schedule F of this press release provides the reconciliation of the Company’s historical adjusted cash flow measures to its cash flow measures.

Management uses adjusted free cash flow to measure the liquidity of its continuing operations and evaluate the Company’s operating cash performance against past periods. Free cash flow is defined as cash provided by (used in) operating activities less capital expenditures. Adjusted free cash flow is defined by the Company as free cash flow adjusted for payments (refunds) that are not reflective of our ongoing operating cash performance. Management believes that the presentation of this adjusted financial measure is useful to investors this quarter because it provides investors with the operating cash flow results that management uses to manage the Company and enables investors and analysts to evaluate the Company’s liquidity from continuing operations.

The following item is excluded from our fourth quarter and fiscal 2015 adjusted free cash flow and adjusted free cash flow margin:

Pension Conversion Payments: Costs incurred as a result of the conversion of the benefits provided to participants in the Company’s Irish defined benefit pension plan to benefits provided under the Company’s Irish defined contribution plan including settlement charges, legal, accounting, tax and other professional fees. We excluded these costs from our adjusted financial measures because they relate to a specific transaction and are not reflective of our ongoing financial performance.

Analog Devices believes that these non-GAAP measures have material limitations in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with GAAP and that these measures should only be used to evaluate our results of operations in conjunction with the corresponding GAAP measures. In addition, our non-GAAP measures may not be comparable to the non-GAAP measures reported by other companies. The Company’s use of non-GAAP measures, and the underlying methodology when excluding certain items, is not necessarily an indication of the results of operations that may be expected in the future, or that the Company will not, in fact, record such items in future periods.

Investors should consider our non-GAAP financial measures in conjunction with the corresponding GAAP measures.