The Internet is going mobile as the technology reaches into the automotive market. The car is set to be a full member of the Internet of Things (IoT), reporting its status and position to servers in the cloud so they can provide updates on where to drive and how long it will take. And internally, it will be its own intranet of things comprising both wired and wireless connections.

There are a number of pressures that drive the motor vehicle into the world of IoT, from better fuel economy to greater comfort and convenience for the driver and passengers. For a growing number of automakers, the mobile phone provides the key to differentiation and convenience. Bluetooth connectivity has already been widely adopted to allow the use of phone conversations by the driver but this is likely to be augmented by the increased use of higher-bandwidth interfaces such as WiFi.

Off-the-shelf support for technologies such as Bluetooth and WiFi provide standard solutions for wirelessly networking a variety of devices, avoiding the need for automotive OEMs and vehicle manufacturers to develop and optimise their own interface standards. For example, as there are profiles for audio in the standard, Bluetooth connections make it easer to install aftermarket audio systems with additional high-quality speakers.

Although untethered aftermarket products will need to rely on their own battery power, the arrival of wireless charging technologies such as the system developed by the Alliance 4 Wireless Power (A4WP) will make it possible to keep them powered while the vehicle’s engine is running.

While connected to the car, apps running in the phone or another connected tablet can help keep the driver updated through the car’s entertainment system on useful information such as nearby filling stations or tourist information. These features could prove to be important differentiators for rental cars as they would allow any car to be personalised to the user the moment they connect their mobile device.

WiFi provides a further benefit to the automaker – during manufacture. Current approaches to firmware updates involve the use of a wired connection to an in-car network based on Ethernet. This demands that the vehicle remain at the uploading and test station for as long as the data transfer and writing to flash memory takes. Very often the limiting factor is the write speed of the different areas of non-volatile memory in the car. By using WiFi instead, uploads to the vehicle can take place while it moves along the production line and other systems and components are fitted, right up to the point at which the vehicle is ready to be driven off for delivery. Similarly, authorised dealers who have the necessary security kits can provide upgrades during service without having to carry a variety of connectors to suit each model of car.

As well as infotainment and connectivity, wireless connectivity can help continue the trend to build increasing intelligence into the car’s core systems, particularly for body-electronics systems. As the designers have succeeded in reducing the weight of body panels and the chassis by moving to composite materials, the wiring loom has become the second heaviest single component in the vehicle – behind the engine itself – weighing more than 50kg and comprising several kilometres of copper wiring.

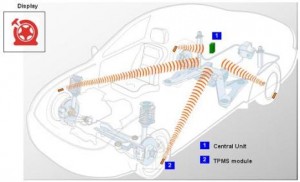

A typical car has up to 60 microcontrollers today, taking in information from a variety of sensors. The number of sensors that can feed important information to in-car control systems is challenging the ability of the wiring harness to keep, providing the impetus to move to wireless-based systems. Wireless communications for safety are already in use through the near-worldwide adoption of the Tyre Pressure Monitoring System (TPMS). In this system, battery-powered sensors fitted inside each tyre regularly update a controller in the car body on changes to air pressure inside each tyre so that it can issue a warning if one or more of the tyres is above or below its approved limits.

TPMS has demonstrated successfully that in-car wireless for core vehicle sensing applications can work. In principle, this approach can be extended to other body-electronics sensing applications, particularly in parts of the vehicle where it would be expensive to provide more cabling that just a basic multi-drop DC power supply. By using smart wireless devices, it becomes easier for a manufacturer to fit different options without having to account for combinations of wired sensor and actuator interfaces. Instead, the network configures itself as devices start up and register themselves with a command hub, that may be wired into the vehicle’s wired networks, such as CAN or Ethernet.

For example, the manufacturer can offer a variety of different seat control options for a vehicle that use increasing amounts of automation to control seat comfort through height and pitch. By using wireless connectivity, the different automated motor controllers can easily be added according to a configuration programmed into the assembly line but, as only power needs to be connected to the nodes, the overall wiring plan for the different kinds of seat is greatly simplified.

There are several wireless protocols to choose from, including Zigbee, which was designed for automation applications and provides communications over distances up to 100m. As a result, Zigbee has been proposed as a potential solution for communication between moving vehicles and roadside data relays that may transmit data on congestion and other useful travel conditions. Another possibility for body electronics is the low-power version of Bluetooth.

Originally launched by Nokia as Wibree in 2006, Bluetooth Low-Energy (BLE) or Bluetooth Smart provides a similar range to classic Bluetooth but with reduced power consumption. In place of the 1MHz channels used by the original Bluetooth protocol, BLE uses a smaller set of wider-bandwidth channels of 2MHz but with a lower peak data rate. The channel bandwidth is similar to that of Zigbee but with narrower spacing.

A key advantage of BLE is its lower latency, just 3ms versus the 100ms of classic Bluetooth, as well as lower complexity so that its software stack can easily be incorporated into lower-cost microcontrollers. BLE retains support for frequency hopping from the original Bluetooth protocol, which makes it more robust than Zigbee in the presence of strong interfering signals.

Microcontroller suppliers such as Freescale Semiconductor, STMicroelectronics and Texas Instruments who are active in automotive markets such as body electronics and infotainment have developed IoT-capable processors that can handle the BLE and WiFi protocol stacks and connections to suitable RF transceivers.

As the car evolves, the vehicle will incorporate increasing amounts of IoT technology to improve not just the driving experience but reduce the cost of manufacture and the cost of ownership.